Effective tax management ensures compliance with tax regulations and accurate calculation of taxes for your transactions. In Malaysia, the Sales and Services Tax (SST) is a key consideration. This section outlines how to set up taxes, manage tax exemptions, and handle SST for your business.

Setting Up Taxes

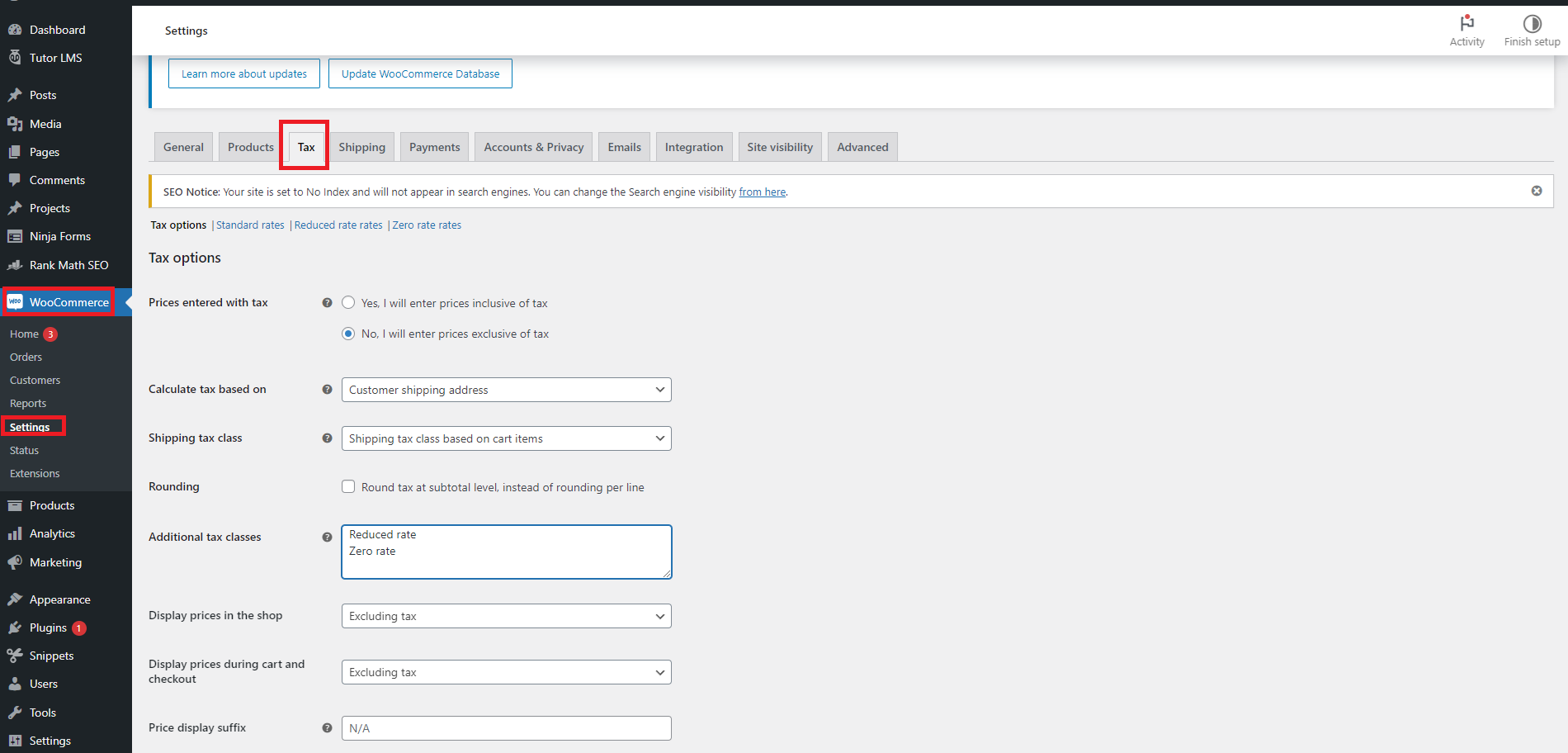

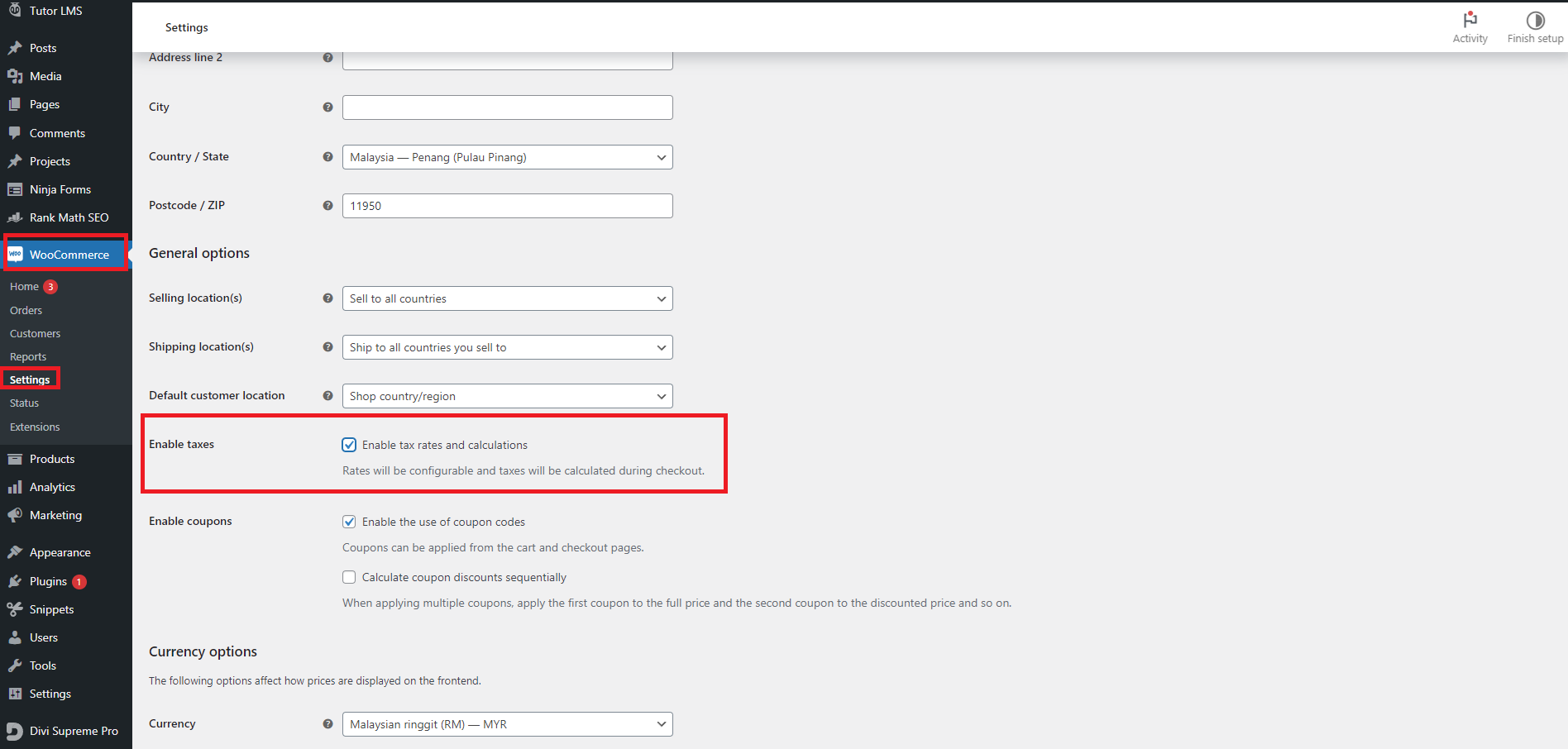

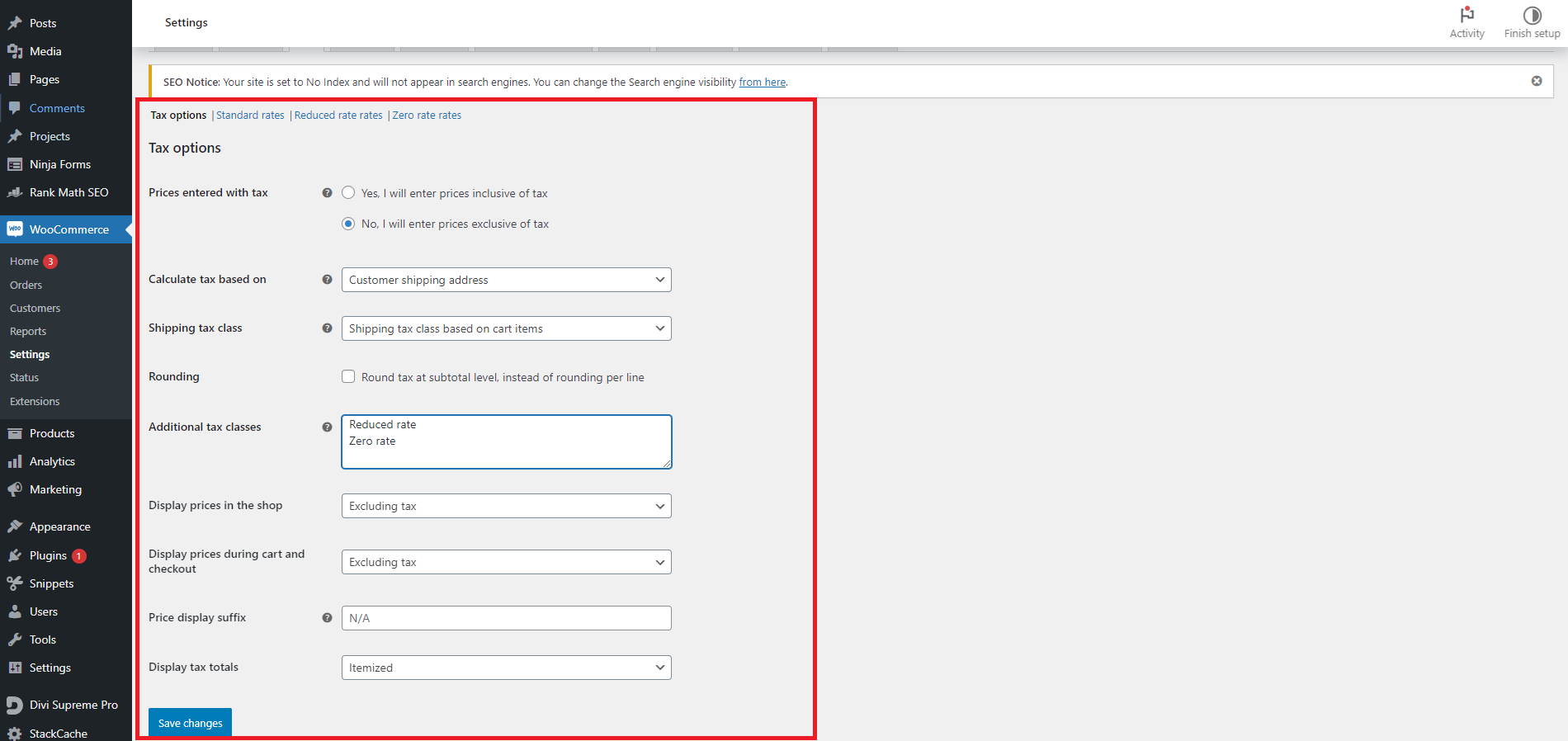

- Access Tax Settings:

- Navigate to Tax Configuration:

- Go to the “Taxes” or “Tax Settings” section in your admin dashboard.

- Configure Tax Settings:

- Ensure that your tax settings are enabled and accessible.

- Navigate to Tax Configuration:

- Add a New Tax Rate:

- Select Tax Rate Management:

- Choose the option to add a new tax rate or create a new tax rule.

- Enter Tax Details:

- Tax Name: Enter a descriptive name for the tax, such as “Sales Tax” or “SST.”

- Tax Rate: Enter the applicable rate for SST (e.g., 6%).

- Tax Description: Provide a brief description of the tax.

- Specify Tax Classes:

- Tax Class: Assign the tax rate to specific tax classes (e.g., Standard Rate).

- Save Tax Rate:

- Click “Save” or “Add” to apply the new tax rate.

- Select Tax Rate Management:

- Set Up Tax Rules:

- Define Tax Rules:

- Country and Region: Specify the regions or states where the tax rate applies. For SST, this will be applicable across Malaysia.

- Include/Exclude Tax Based on Conditions:

- Set conditions for when the tax rate should be applied (e.g., based on product type or total order amount).

- Define Tax Rules:

- Apply Taxes to Products and Services:

- Assign Tax Rates to Products:

- For each product or service, assign the relevant tax rate based on the tax classes you’ve set up.

- Update Product Listings:

- Edit product listings to ensure that the correct tax rate is applied.

- Assign Tax Rates to Products:

Handling Tax Exemptions

- Identify Tax-Exempt Categories:

- Determine Exempt Categories:

- Identify any products or services that are exempt from SST or eligible for special tax rates.

- Document Exemptions:

- Keep detailed records of the products or services that are exempt and the reasons for their exemption.

- Determine Exempt Categories:

- Set Up Tax Exemptions:

- Create Exemption Rules:

- Select Exempt Products/Services: Choose the products or services that are exempt from tax.

- Define Conditions: Specify any conditions that must be met for the exemption to apply.

- Apply Exemptions:

- Ensure that the tax exemption is correctly applied during checkout for eligible transactions.

- Create Exemption Rules:

- Manage Tax-Exempt Customers:

- Add Exempt Customers:

- Add customers who are tax-exempt (e.g., government agencies or registered charities) to your system.

- Assign Exemption Status:

- Update their customer profile to reflect their tax-exempt status and ensure that their transactions are processed accordingly.

- Add Exempt Customers:

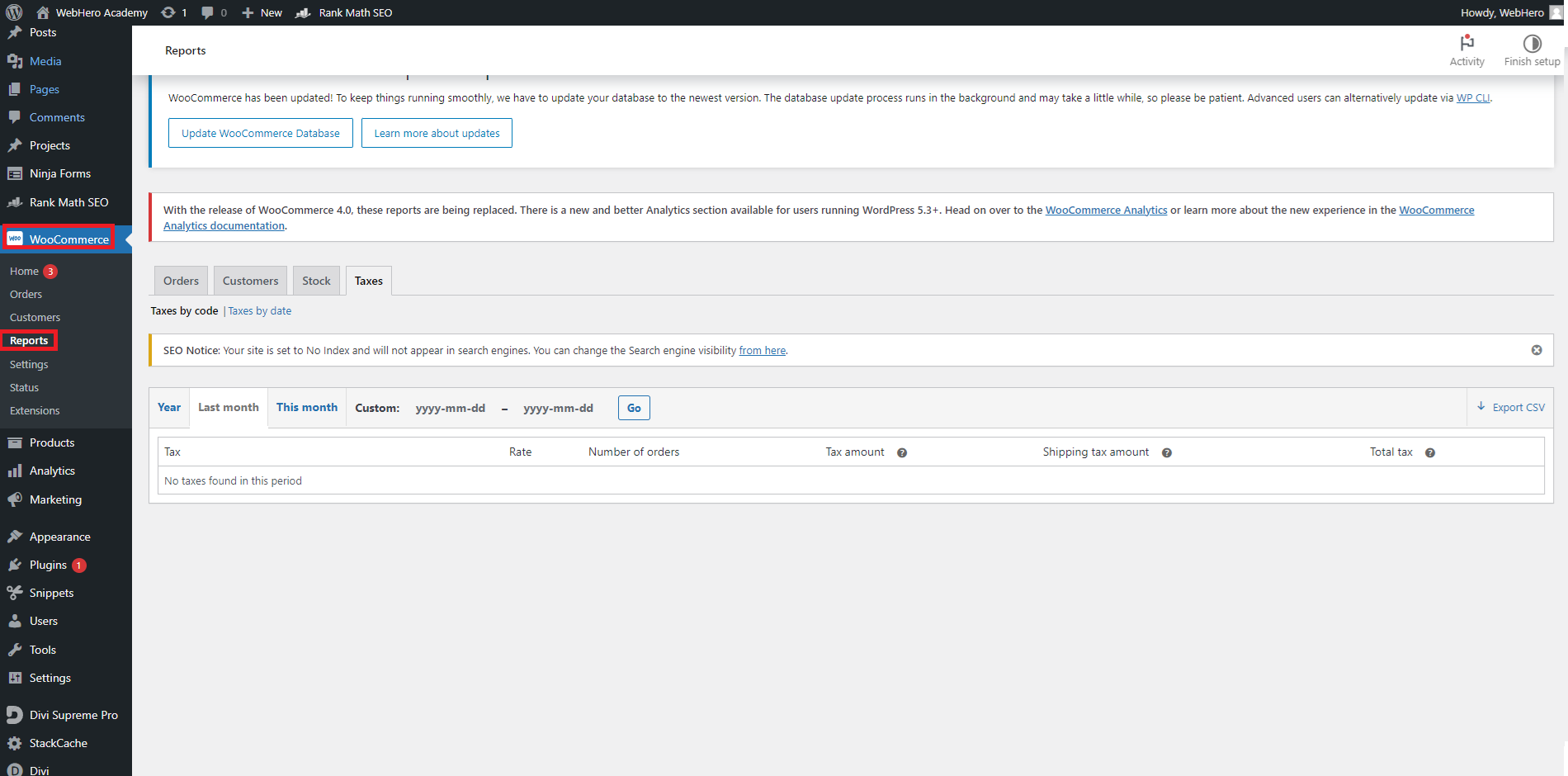

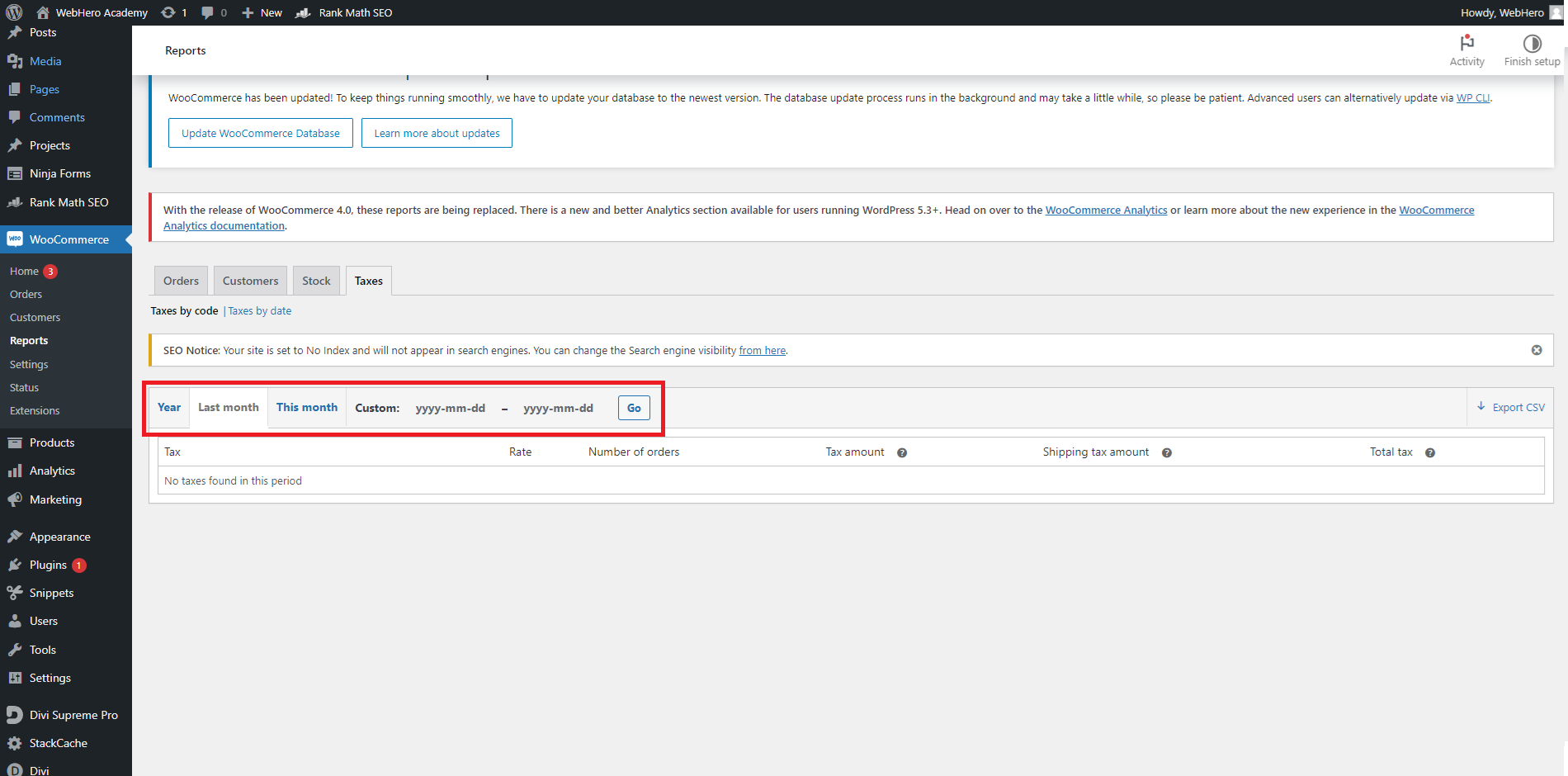

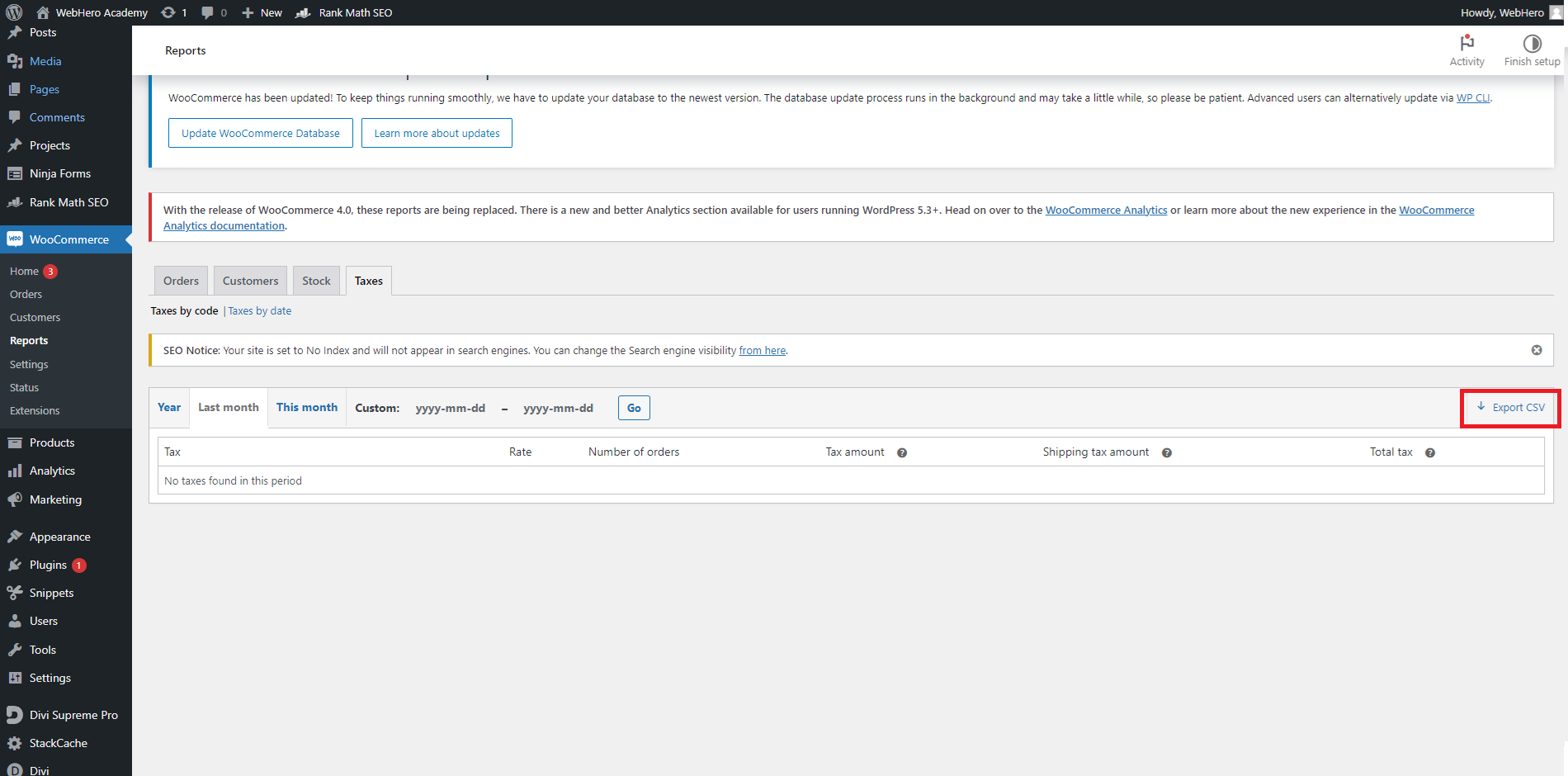

Generating Tax Reports

- Access Tax Reporting:

- Navigate to Reports:

- Go to the “Reports” or “Tax Reports” section in your admin dashboard.

- Generate Tax Reports:

- Select Report Type: Choose the type of report you need, such as SST Summary Report or SST Detailed Report.

- Set Date Range: Specify the date range for the report (e.g., monthly, quarterly).

- Review and Export Reports:

- Generate Report: Click to generate the report.

- Export Report: Export the report in your preferred format (e.g., PDF, CSV) for review and submission to tax authorities.

- Navigate to Reports:

Monitoring and Compliance

- Regularly Review Tax Settings:

- Verify Accuracy:

- Regularly check that your tax rates and exemptions are up-to-date and correctly applied.

- Update Rates as Needed:

- Adjust tax rates or exemptions based on changes in tax laws or business requirements.

- Verify Accuracy:

- Stay Informed on Tax Regulations:

- Monitor Tax Changes:

- Keep up-to-date with any changes in tax regulations that may affect your business.

- Consult Tax Professionals:

- Seek advice from tax professionals to ensure compliance and accurate tax reporting.

- Monitor Tax Changes: